Archive for the 'US Dollar' Category

Fed to Hold Rates for the Near Term

Over the last week, the markets have been abuzz with chatter about how the US recession will soon come to and end, followed by a quick and healthy recovery. According to investor logic, the result would be a rise in inflation and interest rates. This optimism was partially deflated today, as the Federal Reserve bank conducted its annual monetary policy meeting.

Excluding a brief uptick in June (see chart below courtesy of the Cleveland Fed), investors had long come to expect that the Fed would leave its benchmark Federal Funds rate unchanged, at 0-.25%. At the same time, there was a strong belief that the Fed would begin to hike rates at the end of 2009, and comment accordingly in the press release that accompanied its monetary policy decision. Barron’s predicted yesterday: “The statement will acknowledge some improvement in the U.S. economy, though it will imply that this nascent growth reflected in recent gross domestic product reports is fragile and will be monitored closely. This will leave open the specter that interest rates could be increased at some point in the future.”

Sure enough, the Fed left rates unchanged, and its press release conveyed a restrained sense of hope that the worst of the recession is now behind us: “Information received since the Federal Open Market Committee met in June suggests that economic activity is leveling out. Conditions in financial markets have improved further in recent weeks…Although economic activity is likely to remain weak for a time, the Committee continues to anticipate…a gradual resumption of sustainable economic growth in a context of price stability.” The Fed also announced that its Treasury buying activities would soon come to an end, although it may continue to buy mortgage securities as part of its quantitative easing program.

Perhaps the tone of the press release was slightly less positive than investors would have liked, since interest rate futures dived immediately on the news. Especially compared to last week, investors are now assuming that it will be a while before the Fed actually hike rates: “At Wednesday’s settlement price of 99.655, the February fed-funds futures contract priced in about a 38% chance for a 0.5% funds rate after the late-January meeting. That’s down sharply from about a 60% chance at Tuesday’s settlement, about a 76% chance at Monday’s settlement, and about a 96% chance at last Friday’s settlement.” Analysis of options trading activity reveals that the large brokerage houses believe similarly.

As for the Dollar, it now seems possible that last week’s rally was premature. If the Fed isn’t prepared to hike rates anytime soon, then the current interest rate differentials between the US and the rest of the world will remain intact. More importantly, the Dollar will remain a viable funding currency for carry trades, and the shift of funds into higher-yielding alternatives will probably continue for the time being.

Dollar Reverses Course

A recent WSJ headline reads, Good Economic News Threatens the Dollar, and summarizes the Dollar’s trading pattern as follows: “Demand for the U.S. currency continues to erode amid a tide of more encouraging economic data and corporate earnings that have fed a thirst for riskier assets such as stocks, commodities, and growth-sensitive currencies.”

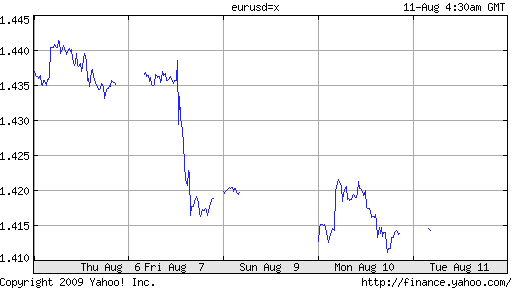

Less than two weeks after that article was published, the Dollar rose by a healthy 2% against the Euro in only one trading session, as US labor market conditions improved slightly: “The U.S. unemployment rate fell in July for the first time in 15 months as employers cut far fewer jobs than expected, giving the clearest indication yet that the economy was turning around from a deep recession.” While technically another 250,000 jobs were lost and economists forecast that the employment rate will rise past 10% before peaking, investor sentiment is still at a high.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home