Jul. 29th 2009

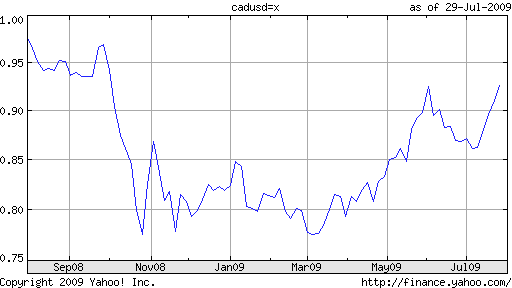

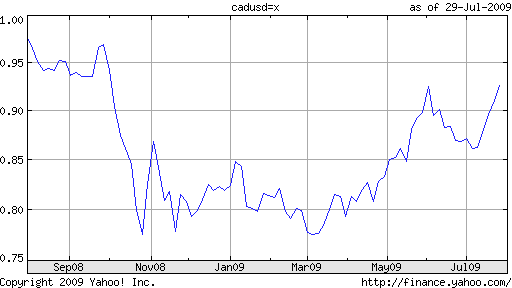

In the same vein as Monday’s and Tuesday’s posts (covering the New Zealand Dollar and Australian Dollar, respectively), I’d like to use today’s post to look at another commodity currency - the Canadian Dollar. The Loonie, it turns out, has also benefited from the a recovery in risk appetite and concomitant boom in commodity prices; it has appreciated by 7% against the USD in the last month alone, en route to a ten-month high. “All in all, with almost everything going its way these days (besides the crummy weather and the impact on tourism), a return trip to parity - last visited nearly one year ago - doesn’t seem far fetched,” chimes one optimistic analyst.

Like Australia and New Zealand, Canada’s economic fate is tied closely to commodity prices. Simply, as oil and other natural resources have inched closer to last year’s record highs, the Loonie has rebounded proportionately. “Raw materials account for more than 50 percent of Canada’s export revenue. Crude is the nation’s largest export.” Of course, this relationship works both ways. Any indication that the global economic recovery is stalling, and commodities prices would likely tumble, bringing commodity currencies down likewise.

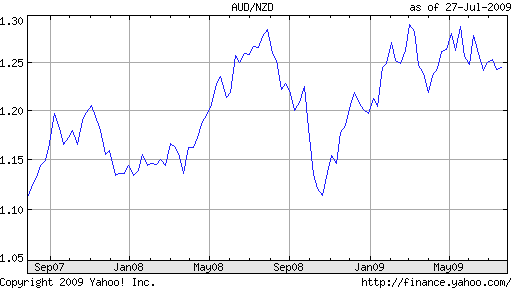

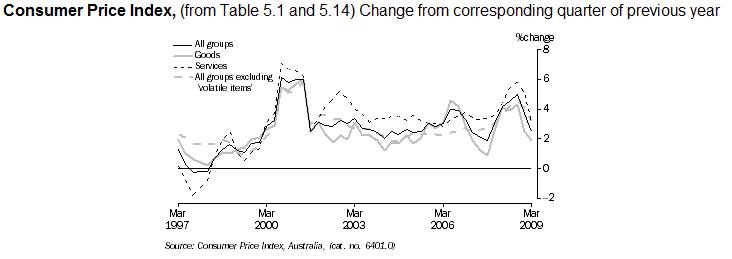

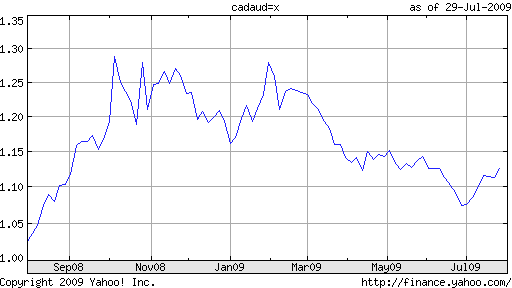

Unlike the Australian Dollar and New Zealand Dollar, the Loonie has never really held much appeal as a carry trade currency. Even at their peak, Canadian interest rates were mediocre, from the standpoint of yield. The current rate is a measly .25%, compared to 2.5% in New Zealand and 3% in Australia. Moreover, while Australia may begin tightening as soon as the fall, “The Bank of Canada committed to keep its key policy rate at the lowest possible level until the spring of 2010,” after voting to hold rates at yesterday’s rate setting meeting. This interest differential could explain why the Aussie has outpaced the Loonie of late.

Another key difference - and potential explanation for the currencies’ recent divergence - is that Australia is considered part of the Asian economic zone, while Canada’s economic fortunes are closely aligned with those of its main trading partner, the US. China, alone, is helping to lift Australia out of recession. The US, meanwhile, is still struggling to find its feet. Hence, it is projected that Canadian GDP will contract by 2.3% in 2009, while Australian GDP may fall by a modest .5%. “When things look bad, you are more likely to sell Canada than the Australian dollar because its economy is moderated by Asian growth,” explains one analyst.

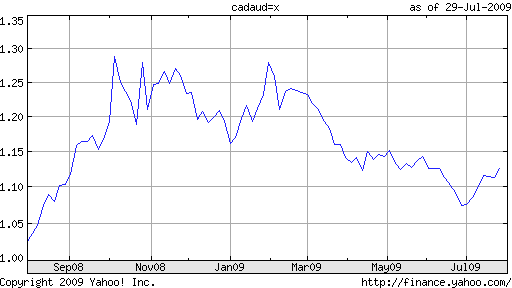

Going forward, this regional differentiation could actually work to the advantage of Canada, which is forecast to grow by an impressive 3% in 2010, compared to 1% growth in Australia. Accordingly, one analyst advises that “Investors should sell Australia’s dollar against Canada’s as a ‘relative commodity play’ because an attempt by China to reign in bank lending on concern it may be creating asset-price bubbles could slow Asian growth…’The Canadian dollar should outperform because it is much more closely linked to a recovery in the U.S.’ “

Forex MegaDroid is the most talked about Forex robot in the past few years and we can all understand why...The most anticipated Forex robot in the past 21 years is finally LIVE...A true multi-market condition robot: trending, non-trending, volatile, non-volatile... Forex MegaDroid nails a 95.82% accuracy rate (out of 100 trades, 95 profitable!). Old technology based robots are a thing of the past... no more of "single market condition" robots... produce a great profit in one market condition, give it all away when the market changes behavior.The Forex MegaDroid robot has produced a 300.20% NET proflt over the past 3 months at 2009. That is 100% (account doubling) performance every single month!How much profit did it produce prior to that? Check it out from my link below,and get free forex killer, free London forex rush, free Gold Miner,free TrendForexSignal and many more worth more than usd100.

Forex MegaDroid is the most talked about Forex robot in the past few years and we can all understand why...The most anticipated Forex robot in the past 21 years is finally LIVE...A true multi-market condition robot: trending, non-trending, volatile, non-volatile... Forex MegaDroid nails a 95.82% accuracy rate (out of 100 trades, 95 profitable!). Old technology based robots are a thing of the past... no more of "single market condition" robots... produce a great profit in one market condition, give it all away when the market changes behavior.The Forex MegaDroid robot has produced a 300.20% NET proflt over the past 3 months at 2009. That is 100% (account doubling) performance every single month!How much profit did it produce prior to that? Check it out from my link below,and get free forex killer, free London forex rush, free Gold Miner,free TrendForexSignal and many more worth more than usd100.